- Categories:About ABA [1]

Business Risk Management for Independent Booksellers [3]

Here, LIBRIS [4], the insurance program created and owned by ABA, provides an overview of potential risks for business owners as well as ways to minimize those risks.

[4]Whether your bookstore is small, medium, or large, there are many risks involved in day-to-day bookstore operations. There is risk in having the public in and out of your space, from hosting special events to serving food or beverages onsite. That’s where good business risk management comes in to help you identify, prioritize, plan for, or mitigate potential losses for your store.

[4]Whether your bookstore is small, medium, or large, there are many risks involved in day-to-day bookstore operations. There is risk in having the public in and out of your space, from hosting special events to serving food or beverages onsite. That’s where good business risk management comes in to help you identify, prioritize, plan for, or mitigate potential losses for your store.

Sometimes owners of small- to medium-sized businesses assume they can’t afford risk management. The opposite is actually true: Business owners can’t afford not to perform a thorough risk assessment to identify and prioritize their risks, take steps to minimize them, and then consider additional coverage to protect any gaps.

Four categories of potential risk for bookstores

“Booksellers’ business risk management is needed no matter the size of your bookstore,” explained Whitney Balaun, business development specialist for the LIBRIS Insurance Program, which is owned by the ABA. “All it takes is a distracted person on their phone in your premises — whether they’re an employee, customer, or vendor — and you’ve got a risk.”

Here is a look at four key areas where your business would benefit from risk management:

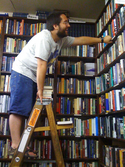

1. Employee risks. Risks concerning your employees range from losing key leaders and a high turnover rate to employee liability, theft, and fraud. Also included in this category are workplace injuries, lost productivity, workers’ compensation claims, and health care costs. In this category of risk, Balaun said, “We have seen claims from bookstores where an employee was accused of embezzlement, and also where employees have been injured from a fall, and the store’s LIBRIS policy provided coverage for these losses.”

1. Employee risks. Risks concerning your employees range from losing key leaders and a high turnover rate to employee liability, theft, and fraud. Also included in this category are workplace injuries, lost productivity, workers’ compensation claims, and health care costs. In this category of risk, Balaun said, “We have seen claims from bookstores where an employee was accused of embezzlement, and also where employees have been injured from a fall, and the store’s LIBRIS policy provided coverage for these losses.”

2. Property risks. Consider not just the physical store, but also your inventory, equipment, and outdoor signage. “One of our policyholders experienced water damage from an adjacent rental space,” said Balaun, “so the damage didn’t even start in the store. This is a loss that a LIBRIS policy is meant to cover.”

2. Property risks. Consider not just the physical store, but also your inventory, equipment, and outdoor signage. “One of our policyholders experienced water damage from an adjacent rental space,” said Balaun, “so the damage didn’t even start in the store. This is a loss that a LIBRIS policy is meant to cover.”

3. Technology and equipment risks. Cyber risks, such as the WannaCry ransomware, are on everyone’s minds. But technology and equipment risks also include equipment breakdown and replacement, data breaches, downtime from broken equipment or outdated systems, fraud, and equipment theft. If your store owns a commercial vehicle or uses an employee-owned vehicle for store operations, having a vehicle in the repair shop or otherwise out of commission may result in lost revenue.

4. Customer and vendor risks. A customer risk can be an accident in the store, one of your vehicles being involved in an auto accident, an irate customer becoming violent, or product recalls. Balaun said that slip-and-fall cases fall into this category. She recounted one in which “a customer was injured because they tripped over an object belonging to the store that had been left outside the door of the store,” and another where “a customer tripped over a small step in the store and was injured.” In each of these cases, the store was required to pay for the customer’s injuries and benefited from its LIBRIS insurance policy.

4. Customer and vendor risks. A customer risk can be an accident in the store, one of your vehicles being involved in an auto accident, an irate customer becoming violent, or product recalls. Balaun said that slip-and-fall cases fall into this category. She recounted one in which “a customer was injured because they tripped over an object belonging to the store that had been left outside the door of the store,” and another where “a customer tripped over a small step in the store and was injured.” In each of these cases, the store was required to pay for the customer’s injuries and benefited from its LIBRIS insurance policy.

Once you’ve created your list of potential risks, next to each note the likelihood of the risk occurring (high, medium, low) and also the impact the occurrence would have (again, high, medium, and low). You’ll first want to address those you ranked high/high (those that have a high likelihood of occurring and would have a significant cost), proceeding down the rankings of urgency.

Your next step in business risk management is to jot down beside each risk what steps you’ve already taken to mitigate an occurrence and what additional activities you need to take (again, ranking by priority). You may want to call on your insurance agent or the LIBRIS team to help with these steps. LIBRIS currently offers feedback on insurance terms in lease agreements for its customers and prospects.

Five simple ways to minimize business risk

“Regardless of your size, there are key areas where you can minimize your risks, often just by improving workplace safety,” Balaun explained.

1. Keep a clean and clutter-free workplace. Outside, repair cracked sidewalks and clearly mark steps or changes in elevation. Pay particular attention to all entryways. Ensure walking paths and narrow aisles inside are free of clutter and trip hazards, such as loose or buckling carpet or flooring. Display prominent signage in areas of high traffic, dangerous equipment, elevation changes, wet floors, or other hazards.

2. Provide proper equipment and safety equipment. Making sure your store is equipped with fire extinguishers, central burglar and fire alarms, cameras, fire walls if next to a restaurant with a grill and/or a deep fryer, and other basic safety precautions will significantly reduce risks.

3. Staff properly. “Not only should new hires be oriented to and trained in their tasks and daily roles, but businesses should also have sufficient staff to achieve their goals, avoiding excessive overtime, overexertion, heavy lifting, and exhaustion,” according to an Inc.com [5] article on risk control, which cited employee fatigue and back strains as a significant contributor to incidents.

4. Train, train again. Every business should offer safety training and have a written safety plan, and every new hire should be trained. Regular safety training should be part of your company’s DNA.

5. Discuss risks. Schedule regular safety meetings with your managers to discuss risks. Your supervisors and workers are an excellent source to recognize safety issues and suggest improvements in their work environment.

Start your own risk assessment with a handy checklist, available here [6]. LIBRIS, owned by ABA, is for booksellers like you. Give us a call at (888) 694-8585 to allow us to help you with your own risk assessment.

For more information:

Small Business Administration: Risk Management for a Small Business [7]

Huffington Post: “Four Reasons Your Small Business Needs Risk Management [8]”

Inc.com: The Importance of Risk Control to Small Businesses [9]