Many states have annual sales tax holidays! On these holidays, purchases can be made tax free and now you can offer these sales tax holidays through your website. With the Sales Tax Holiday feature, it is quick and easy to set up a period of time during which customers on your website will not be charged sales tax.

This feature could also be used as a promotional opportunity if you would like to waive sales tax for customers during a certain period of time.

This feature is available to be enabled upon request. To request this feature, navigate to Store > Configuration > Account Information and Preferences > Store Features and select Sales Tax Holiday. A member of the IndieCommerce team will confirm once the feature has been enabled.

This feature is tied to the Tax Exempt feature. If the Tax Exempt feature is already enabled on your site, Sales Tax Holiday will be too.

Configuring Sales Tax Holiday

-

Navigate to Store > Configuration > Taxes

-

Click “+Sales Tax Holiday”

-

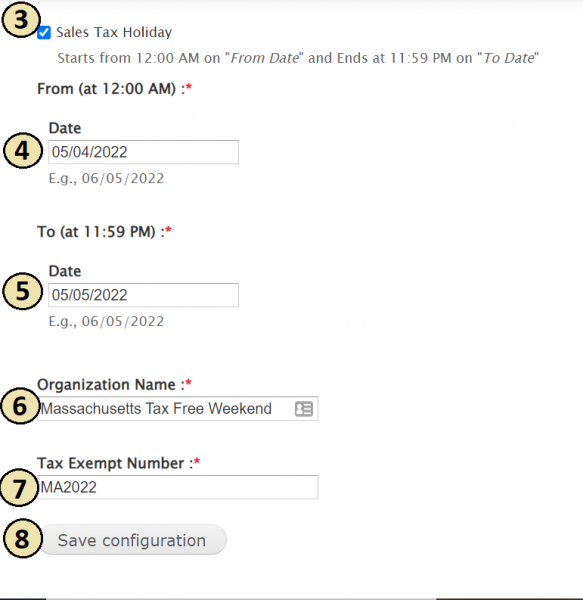

Check the box ‘Sales Tax Holiday’ to expand options

-

Enter a ‘From Date’. Tax Holiday will go into effect at 12:00am on the selected date.

-

Enter a ‘To Date’. Tax Holiday will end at 11:59pm on the selected date.

-

Enter an ‘Organization Name’. This can be any value of your choice. (Example: Massachusetts Tax Free Weekend). This is a required field and the text entered here will help separate Tax Holiday orders from other tax exempt orders

-

Enter a ‘Tax Exempt Number’. This can be any value of your choice. (Example: MA2022). This is a required field and the text entered here will help separate Tax Holiday orders from other tax exempt orders

-

Click ‘Save Configuration’

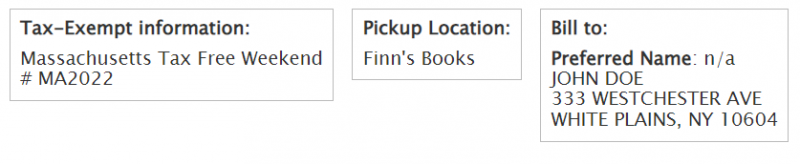

During the duration of the Sales Tax Holiday, a tax exempt pane will appear during checkout and will automatically be populated with the Organization Name and Tax Exempt Number that you have entered.

Orders placed during this time will appear in your order queue with Tax Exempt information, making it easy to identify tax free orders. Tax exemption will only be eligible for orders within the state the store is located.

Note:

-

Orders placed during the Sales Tax Holiday will remain tax free even if edited or processed after the tax-free days, as long as the information in the Tax Exempt pane is not removed by the store staff

-

If, for some reason, an order is not eligible for the Tax Holiday, removing the Tax Exempt information from the order will make the order taxable.